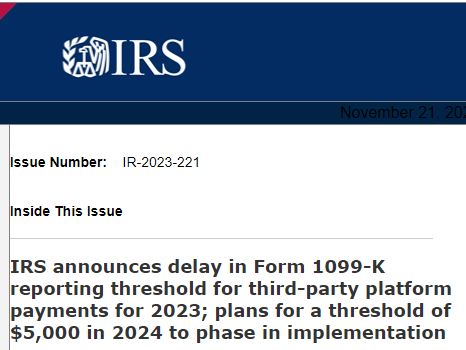

by RightWay | Nov 21, 2023 | IRS, Tax Law

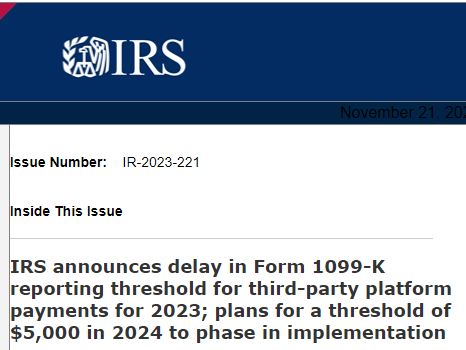

IRS announces 1099-K Phase in… IRS announces delay in Form 1099-K reporting threshold for third-party platform payments for 2023; plans for a threshold of $5,000 in 2024 to phase in implementation It may not be a Christmas Miracle but this Implementation...

by RightWay | Nov 4, 2021 | Uncategorized

On October 21, 2021 the IRS put out a News Release encouraging Tax Preparers to renew their PTINs early through the online renewal process. The renewal process is supposed to take no more than 15 minutes. So, just get it done! Click HERE to read the entire article....

by RightWay | Jan 9, 2021 | Software, Uncategorized

Navigation Instructions In this brief post we are providing navigation instructions to new forms and worksheets related to Economic Impact Payments and the Relief Act, Income “Look Back” Provision for certain tax credits. Pro-Online – Click Links...

by RightWay | Nov 14, 2020 | Features, Pro Online, Software, Uncategorized

DID YOU NOTICE? For all of our pro-online users, we’ve added a little surprise. If you already noticed what were about to share prior to this post, get yourself a cookie Wait? Notice What? As a refresher… In the past, the platform has always...

by RightWay | Nov 2, 2020 | Features, Marketing, Software

WHY WOULDN’T YOU? Everyone loves options! It is now more important than ever to provide your clients as many options as possible to connect and do business with you. Can we ask you a question? If you are not currently promoting the use of the Integrated...