by RightWay | Jun 30, 2021 | IRS, Tax Law, Uncategorized

Who, What, When … Etc. This should go off without a hitch! And be an absolute joy to explain to clients why their refund is smaller! And reconcile on next years tax returns! (Heavy Sarcasm) … None the less, here are the facts. Who is eligible for Advance...

by RightWay | Nov 2, 2020 | Features, Marketing, Software

WHY WOULDN’T YOU? Everyone loves options! It is now more important than ever to provide your clients as many options as possible to connect and do business with you. Can we ask you a question? If you are not currently promoting the use of the Integrated...

by RightWay | Oct 13, 2020 | IRS, Tax Law

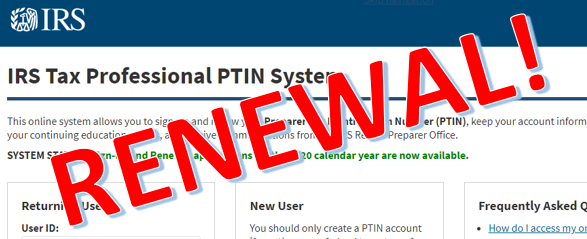

FYI – PTIN Registration is Open! The IRS published a News Release on July 15, 2020 stating in summary: The IRS set a $21 fee per Preparer Tax Identification Number (PTIN) application or renewal (plus a $14.95 fee payable to a contractor). Anyone who prepares or...

by RightWay | Oct 9, 2020 | Business, IRS

As a tax preparer, you’re already well-versed in the tax laws that affect small business owners. This article is meant to serve as a guide to ensure you are compliant in your own business. From choosing a legal structure to collecting tax info for your employees,...

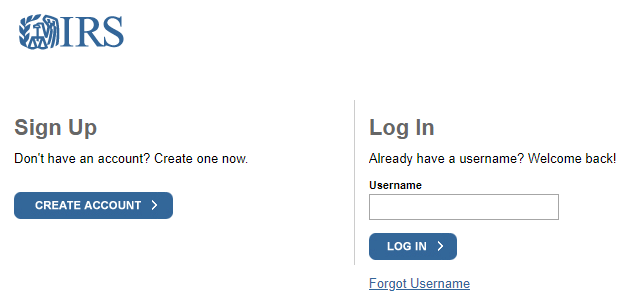

by RightWay | Sep 23, 2020 | Training

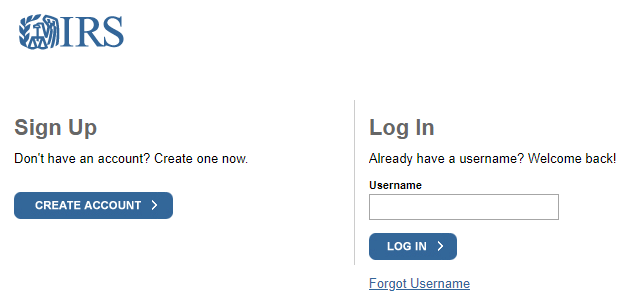

Steps to access e-Services Login Screen We just received a call from a client attempting to locate the IRS e-Services Login Screen. Not sure when the IRS updated the website layout, but they sure made locating the login screen more challenging (buried it)! So,...