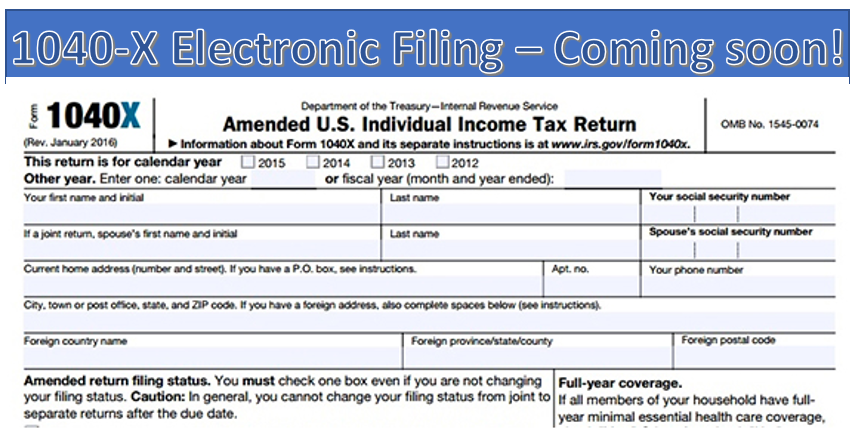

IRS ANNOUNCES THE ABILITY TO ELECTRONICALLY FILE 1040-X

We will be rolling out electronic filing for the 1040X over the next several weeks. We anticipate enabling the ability in Pro Online by the end of September. We will post updates as well roll this out across our product lines.

Now available: IRS Form 1040-X electronic filing Major IRS milestone helps taxpayers correct tax returns with fewer errors, speeds processing

WASHINGTON — Marking a major milestone in tax administration, the Internal Revenue Service announced today that taxpayers can now submit Form 1040-X electronically with commercial tax-filing software.

As IRS e-filing has grown during the past 30 years, the 1040-X, Amended U.S. Individual Income Tax Return, has been one of the last major individual tax forms that needed to be paper filed. Today’s announcement follows years of effort by the IRS, and the enhancement allows taxpayers to quickly electronically correct previously filed tax returns while minimizing errors.

“The ability to file the Form 1040-X electronically has been an important long-term goal of the IRS e-file initiative for many years,” said Sunita Lough, IRS Deputy Commissioner for Services and Enforcement. “Given the details needed on the form, there have been numerous challenges to add this form to the e-file family. Our IT and business operation teams worked hard with the nation’s tax industry to make this change possible. This is another success for IRS modernization efforts. The addition helps taxpayers have a quicker, easier way to file amended returns, and it streamlines work for the IRS and the entire tax community.”

Making the 1040-X an electronically filed form has been a goal for the tax software and tax professional industry for years. It’s been a continuing recommendation from the Internal Revenue Service Advisory Council (IRSAC) and Electronic Tax Administration Advisory Committee (ETAAC).