by RightWay | Oct 9, 2020 | Business, IRS

As a tax preparer, you’re already well-versed in the tax laws that affect small business owners. This article is meant to serve as a guide to ensure you are compliant in your own business. From choosing a legal structure to collecting tax info for your employees,...

by RightWay | Oct 1, 2020 | Uncategorized

Desktop: E-file Amended Returns We have released a 1040 update today for the Desktop / Dashboard programs. After installing it, you will be able to e-file amended returns. Click here to download a short “how to” guide with instructions & screenshots....

by RightWay | Sep 28, 2020 | Uncategorized

E-file 1040X | Pro-Online This is kind of a big deal! If you weren’t aware, the IRS announced early this summer they were going to support e-file for 1040X. The Software has been updated by the Rockstar development team to support this new capability. Below are...

by RightWay | Sep 23, 2020 | Training

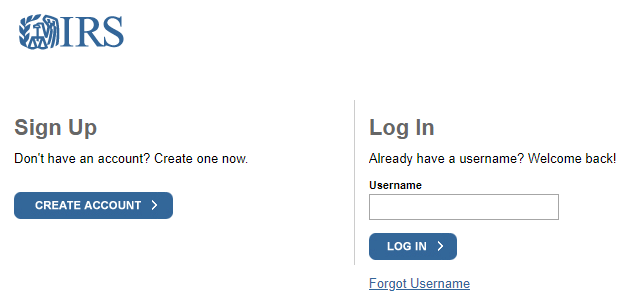

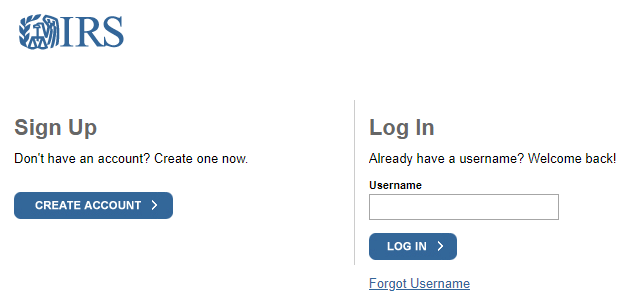

Steps to access e-Services Login Screen We just received a call from a client attempting to locate the IRS e-Services Login Screen. Not sure when the IRS updated the website layout, but they sure made locating the login screen more challenging (buried it)! So,...

by RightWay | Sep 10, 2020 | Uncategorized

As a tax professional, every filing season, you bring the full power of your knowledge and expertise to make sure that your customers get the tax education and maximum refunds they deserve – but are you remembering to include this one very critical service? In this...