E-file 1040X | Pro-Online

This is kind of a big deal! If you weren’t aware, the IRS announced early this summer they were going to support e-file for 1040X.

The Software has been updated by the Rockstar development team to support this new capability.

Below are the steps for electronically filing the 1040X:

- Add the 1040X to the return and complete it as normal.

- Navigate to the e-file section.

- Make sure the federal return is marked for an electronic type.

- If you processed the original return, this should already be complete.

- If you are fixing some other offices mess, select e-file mail check.

- IRS will not Direct Deposit on 1040X yet.

- If client has a balance due, select E-file Mail Payment.

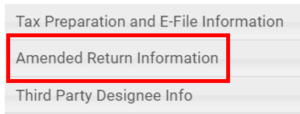

- On the E-file screen there is a New Amended Return Information Menu.

- Click on Amended Return Information to expand.

- Click on Amended Return Information to expand.

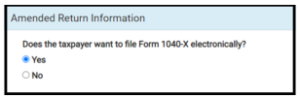

- Answer the Question – Does the Taxpayer want to file Form 1040-X electronically?

- Select yes

- Select yes

- Complete all the necessary fields to E-file.

- From the submission page, you will see the option to Save And Transmit Amended Return

- When you are ready to Submit to the IRS, Select:

- When you are ready to Submit to the IRS, Select:

Frequently Asked Questions?

Q: What years can I electronically file a 1040X?

A: 2019 and forward

Q: Can I electronically file state amended returns?

A: No, we are not currently supporting the electronic filing of any state amended returns

Q: What does it mean if my 1040X is rejected for the primary SSN already being on file?

A: Most likely the taxpayer completed the EIP tool on IRS.gov or their return was electronically filed and was classified as an EIP return.

Q: Can I electronically file a 1040X if the original 1040 was filed via paper?

A: No, the IRS MEF system must have an accepted 1040 return on file

Q: Did my site have to submit the original 1040 electronically to file the 1040X electronically?

A: No, however the return must be an accepted 1040 return on file in their MEF system.

Q: How do I file a 1040X electronically if I did not prepare and file the original return

A: You will follow the same procedures you have in place if a taxpayer comes to you wanting you to prepare a 1040X. You need to verify that they electronically filed the original return and you are inputting the return as it was originally accepted.

Q: If the taxpayer is getting additional money back, how will it be received?

A: Via paper check

We hope this helps!