by RightWay | Dec 2, 2021 | IRS, Security

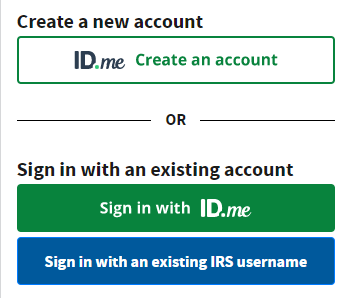

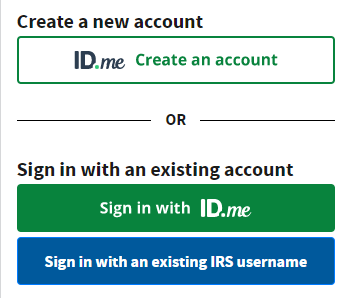

IRS unveils new online identity verification process for accessing self-help tools The IRS ID Verify process was way over due for an upgrade. Successfully verifying on their old platform was an act of God. Rumor is this process is much easier… probably because...

by RightWay | Jun 30, 2021 | IRS, Tax Law, Uncategorized

Who, What, When … Etc. This should go off without a hitch! And be an absolute joy to explain to clients why their refund is smaller! And reconcile on next years tax returns! (Heavy Sarcasm) … None the less, here are the facts. Who is eligible for Advance...

by RightWay | Oct 13, 2020 | IRS, Tax Law

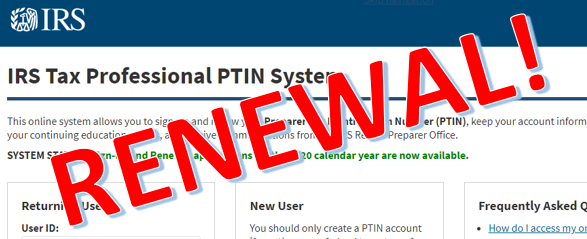

FYI – PTIN Registration is Open! The IRS published a News Release on July 15, 2020 stating in summary: The IRS set a $21 fee per Preparer Tax Identification Number (PTIN) application or renewal (plus a $14.95 fee payable to a contractor). Anyone who prepares or...

by RightWay | Oct 9, 2020 | Business, IRS

As a tax preparer, you’re already well-versed in the tax laws that affect small business owners. This article is meant to serve as a guide to ensure you are compliant in your own business. From choosing a legal structure to collecting tax info for your employees,...

by RightWay | Aug 18, 2020 | IRS, Tax Law

IRS announces 2021 PTIN Fees for tax return preparers WASHINGTON — The Internal Revenue Service announced today the annual fee for 2021 that tax return preparers must pay to apply for or renew their Preparer Tax Identification Number (PTIN). In final...