News & Articles

Professional tax tips, news, and updates that impact how you run a professional tax office.

Sign Up For Blog Updates

Did You Notice?

DID YOU NOTICE? For all of our pro-online users, we've added a little surprise. If you already noticed what were about to share prior to this post, get yourself a cookie Wait? Notice What? As a refresher... In the past, the platform has always allowed...

Side By Side Comparison – Bank Matrix

BANK MATRIX - Program Comparison Keeping track of what each bank is offering what is quite a challenge. Well, it would be if ... you didn't have an awesome Matrix for easy side by side comparison. Little Caveat: This matrix is our best attempt to summarize tons of...

Why Wouldn’t You? – Branded Mobile App

This year more than any other it is imperative for tax offices to provide their customers options to do business with them! Our mobile app is an amazing option!

E-file Shutdown Date – 11/21/2020

IRS Quick Alert: Cutover 1040 Modernized e-File (MeF) Production Shutdown and Cutover The IRS announced that E-file will "shutdown" will begin on Saturday, November 21, 2020, at 11:59 p.m. Eastern time, in order to prepare the system for the upcoming Tax Year 2020...

2021 Tax Season PTIN Registration – OPEN

FYI - PTIN Registration is Open! The IRS published a News Release on July 15, 2020 stating in summary: The IRS set a $21 fee per Preparer Tax Identification Number (PTIN) application or renewal (plus a $14.95 fee payable to a contractor). Anyone who prepares or...

Is your Tax Business setup the RightWay

As a tax preparer, you’re already well-versed in the tax laws that affect small business owners. This article is meant to serve as a guide to ensure you are compliant in your own business. From choosing a legal structure to collecting tax info for your employees,...

E-FILE 1040X – Desktop Update

Desktop: E-file Amended Returns We have released a 1040 update today for the Desktop / Dashboard programs. After installing it, you will be able to e-file amended returns. Click here to download a short "how to" guide with instructions & screenshots.

Pro-Online | E-file 1040X / Amended Return

E-file 1040X | Pro-Online This is kind of a big deal! If you weren't aware, the IRS announced early this summer they were going to support e-file for 1040X. The Software has been updated by the Rockstar development team to support this new capability. Below are the...

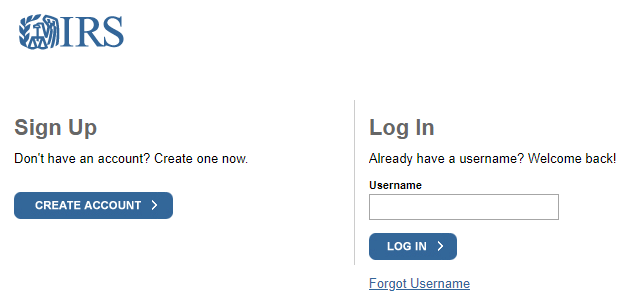

Accessing your IRS e-Services Login

5 Steps to logging in to IRS e-Service

Identity Theft – How to fight back!

As a tax professional, every filing season, you bring the full power of your knowledge and expertise to make sure that your customers get the tax education and maximum refunds they deserve – but are you remembering to include this one very critical service? In this...