News & Articles

Professional tax tips, news, and updates that impact how you run a professional tax office.

Sign Up For Blog Updates

Hot Off The Press | 1099-K Threshold Delay

IRS announces 1099-K Phase in... IRS announces delay in Form 1099-K reporting threshold for third-party platform payments for 2023; plans for a threshold of $5,000 in 2024 to phase in implementation It may not be a Christmas Miracle but this Implementation...

1040 Modernized e-File (MeF) Production Shutdown – 22

Reminder: The IRS announced that the last day to electronically file individual 1040 tax returns is Saturday, November 26, 2022. All returns must be transmitted prior to 11:59 PM eastern time in order to be processed. The temporary shutdown of the Modernized e-File...

PTIN Renewal Time!

Tax Season is right around the corner... PTIN Renewal time again! All current PTINs will expire December 31st 2022 There are more than 750,000 active tax return preparers in the United States and if you're one of them, it's time to start renewing your Preparer Tax...

IR-2022-08: 2022 Tax Filing Season Begins Jan. 24

IR-2022-08: 1/10/22 E-file Start Date Announced WASHINGTON − The Internal Revenue Service announced that the nation’s tax season will start on Monday, Jan. 24, 2022, when the tax agency will begin accepting and processing 2021 tax year returns. The January 24 start...

20 Vs. 21 Comparison | Tax Law Updates

YR/YR Tax Comparison Below is a download link for a 20 VS. 21 comparison of most significant changes. Download PDF of 2021 vs. 2020 comparison of tax changes We strongly advise everyone become well acquainted with these changes!

Data Security Plan – Do you have one?

Data Security Plan Today, December 13, 2021 the IRS published Tax Tip 2021-184. In this "Tip" they mention something that most Tax Pro's probably aren't aware of or forgot about. They make sure to point out that, "The IRS and Security Summit partners remind tax...

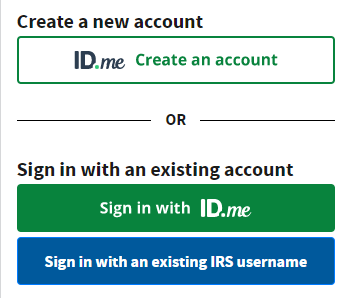

NEW: IRS Tax Payer ID Verify Tools!

IRS unveils new online identity verification process for accessing self-help tools The IRS ID Verify process was way over due for an upgrade. Successfully verifying on their old platform was an act of God. Rumor is this process is much easier... probably because they...

2022 Season | Renew Your PTIN Now!

On October 21, 2021 the IRS put out a News Release encouraging Tax Preparers to renew their PTINs early through the online renewal process. The renewal process is supposed to take no more than 15 minutes. So, just get it done! Click HERE to read the entire article....

E-FILE SHUTDOWN DATE – 11/20/2021

IRS QUICK ALERT: CUTOVER 1040 MODERNIZED E-FILE (MEF) PRODUCTION SHUTDOWN AND CUTOVER The IRS announced that E-file will “shutdown” will begin on Saturday, November 20, 2021, at 11:59 p.m. Eastern time, in order to prepare the system for the upcoming Tax Year 2021...

2022 Tax Season – Significant Tax Updates

CLIFFNOTE: Tax Law Updates Here is a quick teaser - Did you know for 2021, there is no MAX age for EITC. Your client could be 80 years old and still be eligible! This is our short list of significant updates you need to know about .. Click HERE to download "Cliff...