by RightWay | Aug 18, 2020 | Best Tax Software, Features, IRS, Software, Tax Software

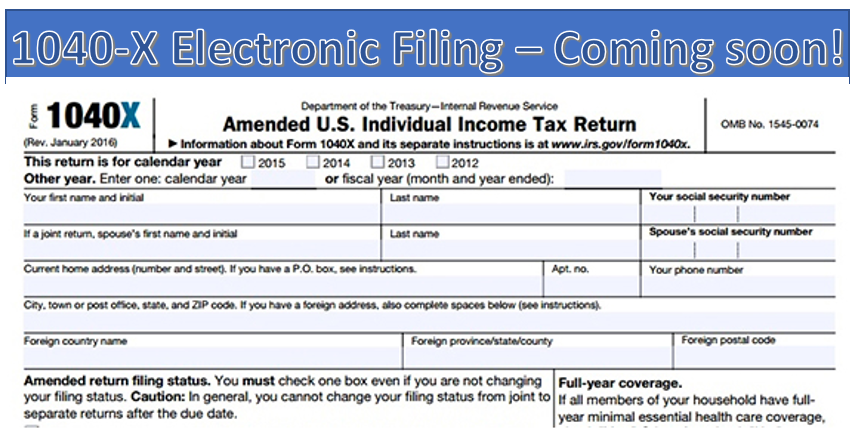

IRS ANNOUNCES THE ABILITY TO ELECTRONICALLY FILE 1040-X We will be rolling out electronic filing for the 1040X over the next several weeks. We anticipate enabling the ability in Pro Online by the end of September. We will post updates as well roll this out across...

by RightWay | Aug 18, 2020 | IRS

Over the last few weeks we received a number of calls regarding taxpayers refund checks being slightly larger than anticipated. We correctly concluded the difference had to be interest payments from the IRS. We have never seen so many payments with interest but...

by RightWay | Apr 28, 2020 | IRS, Marketing, Training, Uncategorized

Due to the Virus craziness, E-file numbers have taken a steep dive into the toilet. Last year at this same time, more than 126 Million Tax returns had been filed. As compared to the most recent IRS numbers reporting less than 106 Million filings. Which translates to...

by RightWay | Oct 29, 2019 | IRS, Tax Law, Training

1040 MeF Cutover Date and Time The IRS just put out a Quick Alert for Tax Professionals alerting everyone to the upcoming e-File Shutdown. Every year the IRS shuts down the e-File system to prepare for the upcoming tax season. The date for this years cutover is...

by RightWay | Sep 27, 2019 | IRS, Tax Law

Not much to say on this topic but we though it was worth letting you know. For the upcoming filing season. the IRS recently announced the W-2 verification code will be going away. Why? Well, they implemented this thing called technology which makes things faster and...

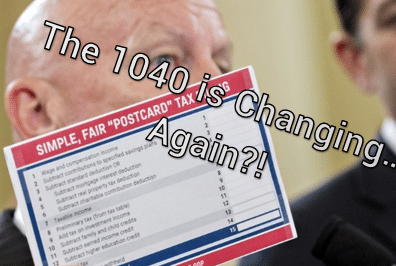

by RightWay | Sep 12, 2019 | IRS, Tax Law, Training

Yeah, “Postcard” In 2018, the IRS introduced the “postcard” Form 1040. The new 1040 was promoted as a simpler version of the previous two‐pager. To “reduce” the size of the 1040, the IRS blew it apart and moved certain pieces to six new...