by RightWay | Dec 14, 2021 | Uncategorized

Data Security Plan Today, December 13, 2021 the IRS published Tax Tip 2021-184. In this “Tip” they mention something that most Tax Pro’s probably aren’t aware of or forgot about. They make sure to point out that, “The IRS and Security...

by RightWay | Dec 2, 2021 | IRS, Security

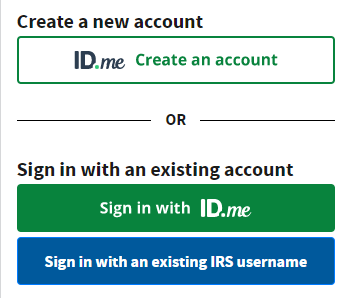

IRS unveils new online identity verification process for accessing self-help tools The IRS ID Verify process was way over due for an upgrade. Successfully verifying on their old platform was an act of God. Rumor is this process is much easier… probably because...

by RightWay | Nov 4, 2021 | Uncategorized

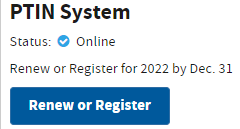

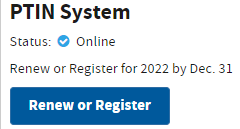

On October 21, 2021 the IRS put out a News Release encouraging Tax Preparers to renew their PTINs early through the online renewal process. The renewal process is supposed to take no more than 15 minutes. So, just get it done! Click HERE to read the entire article....

by RightWay | Nov 4, 2021 | IRS

IRS QUICK ALERT: CUTOVER 1040 MODERNIZED E-FILE (MEF) PRODUCTION SHUTDOWN AND CUTOVER The IRS announced that E-file will “shutdown” will begin on Saturday, November 20, 2021, at 11:59 p.m. Eastern time, in order to prepare the system for the upcoming Tax Year 2021...

by RightWay | Oct 26, 2021 | Uncategorized

CLIFFNOTE: Tax Law Updates Here is a quick teaser – Did you know for 2021, there is no MAX age for EITC. Your client could be 80 years old and still be eligible! This is our short list of significant updates you need to know about .. Click HERE to download...