In this article we have compiled the major IRS form updates for tax year 2020.

Many of these forms are specific to dealing with Covid-19 and the reemergence of an old classic (1099-NEC)

New tax forms for 2020

Form 1099-NEC

The 1099-NEC disappeared in the early 80’s and after a 38 absence is making a disco comeback!

This form will be used to report nonemployee compensation in box 1, meaning that nonemployee compensation will no longer be reported on Form 1099-MISC.

Form 1099-NEC will need to be entered on a Schedule C. This form should be issued to your client by January 31, the same deadline for Form W-2. Box 4 will be used to report any backup withholding.

Form 5884-A – Employee Retention Credit

This is a new form that will be used to report a refundable credit that employers may receive under the CARES Act for retaining employees when their businesses were required to shut down due to COVID-19.

For more information about Form 5884-A, read How Will the CARES Act Affect My Clients’ 2020 Taxes?

Form 7202 – Credits for Sick Leave and Family Leave for Certain Self-Employed Individuals

This form will be used to calculate the refundable credits for sick and family leave caused by the COVID-19 outbreak. The sum of the sick leave credit and the family leave credit will be included on Schedule 3 (Form 1040), line 12b.

Form 8915-E

Form 8915-E will be used to report distributions and repayments for 2020 qualified disasters and 2020 distributions subject to the CARES Act, which allows up to $100,000 in distributions spread out over three years.

Updated tax forms for 2020

Form W-4

Form W-4 was completely redesigned for tax year 2020. The goals of the redesign were to align the form with the changes resulting from the Tax Cuts and Jobs Act and prevent people from under-reporting their allowances. There is a new 5 step process that guides taxpayers through the form. The updates include:

- Personal withholding allowances were eliminated

- Step 3 allows taxpayers to indicate that they are eligible for the Child Tax Credit or the Other Dependent Credit

- Step 4 is an optional section that allows taxpayers to make adjustments for additional withholding, reduce withholding, and enter additional income tax they would like withheld from each paycheck

- The exemption line was removed

Form 1040

There are several changes to Form 1040 this year.

- Line 30 has been added for the Recovery Rebate Credit

- Line 10b has been added to account for charitable cash contributions up to $300 being treated as above-the-line deductions (reported on Schedule A)

- There are three separate lines for withholdings

- The question about cryptocurrency has been moved higher up on the form

Form 1099-MISC

With the reinstatement of Form 1099-NEC to report nonemployee compensation (details above), Form 1099-MISC has been updated for 2020.

The box numbers have been rearranged to comply with the removal of nonemployee compensation.

- Box 7 – Payer made direct sales of $5,000 or more

- Box 9 – Crop insurance proceeds

- Box 10 – Gross proceeds to an attorney

- Box 12 – Section 409A deferrals

- Box 14 – Non-qualified deferred compensation income

- Boxes 15 – State taxes withheld

- Box 16 – State identification number

- Box 17 – Amount of income earned in the state

Clients expecting a 1099-MISC should receive the form by February 28. This due date has also changed from previous years.

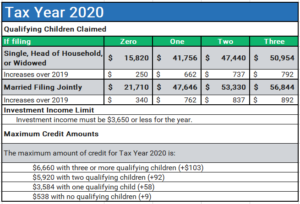

Updated EIC Amounts

As is every year, the income limits and maximum credit amounts for EIC adjust for inflation. The below blurry image (sorry) reflects those changes … if you squint, the amounts show up clearly.

Hope this helps and Merry Christmas to ALL!