1099-NEC = NEW FORM

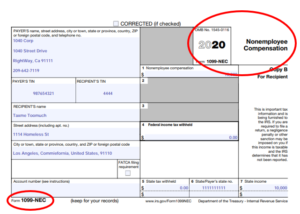

Form 1099-NEC is used by payers to report payments of $600 or more made in the course of a trade or business to others for services. Prior to 2020, these payments were reported in box 7 on Form 1099-MISC. Payers must provide a copy of 1099-NEC to the independent contractor by January 31 of the year following payment.

Don’t go looking for it yet in the Pro-Online Software. We are putting on the final touches and will be updating the software shortly.

Click Here to read IRS 1099-NEC Instructions

Payments reported as nonemployee compensation (NEC) have four characteristics:

- The payments made during the year totaled $600 or more.

- The payee was not an employee of the payer.

- Payment was made in the course of a trade or business, including nonprofits and government agencies.

- Payment was made to an individual, a partnership, or an estate; or, payment was made to a corporation if the payment was for fish purchases or attorney fees.

Form 1099-NEC Box 1 is used to report $600 or more paid in the course of business for:

- Services, including parts and materials, performed as an independent contractor.

- Oil and gas payments for a working interest, irrespective of whether services were performed or not.

- Purchases of fish or other aquatic life from a person engaged in the business of fishing.

- Attorney fees paid to an attorney. (Note: gross proceeds paid to attorneys continue to be reported in Box 10 of Form 1099-MISC.)

- Nonqualified deferred compensation includible in gross income because the NQDC plan doesn’t satisfy the requirements of section 409A.

Form 1099-NEC Box 4 is used to report backup withholding, irrespective of the amount in Box 1.